Intermediate Financial Adulting 101:

Getting Started

I’m no financial Guru. I can’t tell you what stocks will make you rich or give you any secret system for gaining financial independence. I can tell you what I wish someone had told me when I was just starting out. I hope it helps!

Let’s be direct. You’re starting your career, making some real money for the first time in your life, and starting to think about your financial future. Your first instinct will be to go to a bank for “advice.” That’s a good start, but you need to understand what a bank will provide versus what you may need.

What you need at this point in your life is a plan, but most institutions will sell you a product.

What you actually need is a strategic roadmap for your life, a plan that models different scenarios for buying a home, for your retirement, for your freedom.

What the bank is incentivized to sell you is a mutual fund. They sell hammers, and their answer to every problem is a nail.

I know, building a plan seems like a lot of work. You won’t do all of it at once.

But you already work 40+ hours a week. You trade your most valuable asset—your time—for money. Spending a fraction of that time learning how to manage that money is the highest-leverage activity you can engage in. This isn’t a side quest; it’s the main story.

Guess what, they should have taught you this in high school. They didn’t. The hard truth is that most (if not all) of your teachers were likely as financially illiterate as the rest of us. The system is designed to teach you how to earn an income, not how to build wealth

You have to seize that education for yourself. True financial sovereignty comes from architecting your own plan.

Part 1: The Core Thesis: Your Plan, Not Their Products

Here is the most important statistic in finance: over any 10–15 year period, nearly 90% of professional, actively managed investment funds fail to outperform a simple, low-cost index fund.

Read that again. The very products the industry is built to sell you—the ones managed by highly paid “experts”—statistically fail to do the one thing they promise. The “product” is not the ticket to wealth. The fees you pay for it, however, are a guaranteed ticket to wealth for the person who sold it to you.

Wealth is not built by finding a magical product. It is built by executing a disciplined, personal plan.

Part 2: The Defensive Strategy (The Foundation of Your Plan)

Forget the noise. The core of your plan is a simple, powerful formula:

- Create a significant gap between your income and your spending. This surplus is the raw material for wealth.

- Automate the saving of that surplus.

- Invest it relentlessly in a low-cost, tax-efficient (very important!), and disciplined manner over decades.

That’s the plan. It’s not sexy, but it works.

A critical note: Right now, you are probably “in the hole”—your student loans and credit card debt might be greater than your assets. That’s normal. It doesn’t mean you wait to make a plan. It means you need a plan now more than ever. Your first plan is the debt-destruction plan.

Part 3: The Offensive Strategy (How to Earn Wealth, Not Just an Income)

The plan above is your defense. Now for the offense. Your salary is just one part of the equation. Extraordinary wealth is often built by acquiring ownership and leveraging your skills outside a 9-to-5 paycheque.

- Workplace Matching Programs (RRSP/401k): This is free money. It is the only guaranteed 100% return on investment you will ever see. If your employer offers to match your contributions, you take it.

- Stock Options & Equity: This is how you gain ownership. Working for a salary makes you a renter of your time. Owning equity makes you an owner of the business.

- Joining a Start-up: A high-risk, high-reward career bet. You trade stability for a potentially life-changing equity stake.

- Entrepreneurship: The ultimate form of ownership. Start a small business on the side (don't let it impact your day job though!). It diversifies your income and gives you an asset you can grow and potentially sell.

Part 4: Taxes Kill Wealth (Know The Tools)

Your plan requires the right tools. The Canadian government provides a set of tax-advantaged accounts. Using them correctly is how you protect your plan from the drag of taxes (your biggest expense).

Account Types:

- TFSA (Tax-Free Savings Account): The Cornerstone of Your Plan. A god-tier account where your money grows and can be withdrawn completely tax-free. Your priority account to max out.

- RRSP (Registered Retirement Savings Plan): The Tax-Deferral Tool. You get a tax break today, but you’re just deferring the tax until retirement. Use it, especially to get the company match.

- RESP (Registered Education Savings Plan): A long-term account designed for education savings. The government adds a 20% Canada Education Savings Grant (CESG) on your contributions, up to $500 per year. Even if you don’t have kids yet, it’s important to know this exists—if and when you do, opening an RESP early maximizes the free money and long-term growth.

- FHSA (First Home Savings Account): The Home-Buying Cheat Code. A hybrid that gives you a tax deduction on the way in and tax-free withdrawals for a home. A no-brainer if you plan to buy.

- Non-Registered (Taxable) Account: The Overflow Bucket. Where you invest after your other accounts are full. It’s flexible but inefficient. The tax man will take a piece of your gains here.

- High-Interest Savings & GICs (inside TFSA/RRSP or taxable): Safe cash sleeve for emergency fund and near-term goals; also for glidepath de-risking.

- Implementation Vehicles (All-in-One ETFs or Robo-Advisors): Low-cost, globally diversified, automatically rebalanced—keeps behavior and fees in check.

- Fee-Only Financial Planner (Fiduciary): Flat-fee planning without product commissions; use for one-time plan build or periodic checkups.

- Employer Plans (Group RRSP/DPSP, DC/DB Pension): Capture every dollar of employer match; pensions materially change retirement math—know your accruals/vesting.

- Employee Share Programs (ESPP, RSUs, Stock Options): Treat employer equity as part of your portfolio; set sell rules to avoid over-concentration.

- Spousal RRSP: Income-splitting tool for couples with uneven incomes; can lower total lifetime tax.

Part 5: The Strategy for Life’s Big Moves (Executing Your Plan)

Your financial plan is a direct reflection of your life’s timeline. Here’s how to apply these concepts to your real-world goals.

1. Buying a House (Horizon: 3-10 years)

- The Mindset: For most people, their first home is the single most important wealth-building tool they will ever have. Every rent cheque you sign is helping build your landlord’s equity. Your goal is to stop paying for someone else’s asset and start building your own. Get into the market as soon as you responsibly can. If that means swallowing your pride and living with your parents for two years to scrape together a down payment, you do it.

- The Goal: The objective isn’t just to “own a home.” It’s to maximize your tax-free capital gain when you eventually sell. The government gives you a massive gift: the profit on the sale of your primary residence is tax-free. Your strategy should be built around making that number as big as possible.

- The Mortgage Strategy: Don’t just accept the first rate the bank offers. Understand the interest rate environment to choose between variable and fixed. Most importantly, demand aggressive pre-payment options. When you get a bonus or a raise, a portion of it should go directly to paying down your mortgage principal. Every extra dollar you pay down is a risk-free, tax-free return that accelerates your equity growth.

2. Buying a Car (Horizon: 1-3 years)

- The Mindset: A car is a rapidly depreciating asset. It is a tool for getting you from A to B, not a status symbol you should go into significant debt for. Your goal is to minimize this guaranteed financial loss.

- The Strategy: Never Buy New: A new car loses 10-20% of its value the second you drive it off the lot. Let someone else pay for that depreciation. The sweet spot is a car that is 1-2 years old with low mileage. Get the Warranty: For a used car, an extended warranty is not an upsell; it’s your shield against catastrophic repair bills that can wreck your budget. Negotiate the Perks, Not Just the Price: In today’s market, the sticker price might be firm. Fine. But you can negotiate on other things. Push for free oil changes for two years, a set of winter tires, or free maintenance checks. These have real value. Avoid Leasing: Leasing is a rental, not a path to ownership. It’s designed with mileage limits and wear-and-tear clauses that can lead to expensive surprises when you turn it in. The “Cheapest Car You Can Stand to Drive” Rule: This is the golden rule. Don’t buy a car you will actively hate every time you get in it—life is too short. But unless you can buy it with cash without derailing your other financial goals, you have no business buying a “dream car.” Your dream car is a luxury you can afford when the cost is no longer a major overhead item in your life. Until then, you buy reliable, safe, and cost-effective transportation.

3. The Modern Approach to Education Savings (Horizon: 18+ years)

- The Mindset: The old script was simple: “Save for university so your kids can get a good job.” The new reality is more complex. Is a university degree still a guaranteed predictor of higher income? In the U.S., the data is increasingly grim. The cost of tuition has exploded, leading to crippling student debt that can negate the income advantage for many graduates, particularly outside of elite schools and STEM fields. In Canada, the picture is better, but the warning signs are there. University graduates in Canada still, on average, earn significantly more over their lifetimes than those without a degree. However, tuition is rising, and the key is the Return on Investment (ROI) of the specific degree. An engineering or computer science degree has a much clearer and faster payback than many arts degrees.

- The New Goal: Your objective is not just to “save for school.” It is to give your child a launch pad for their adult life, with minimal or zero debt. The goal is financial freedom, not just a degree. A mountain of student debt is the opposite of freedom; it’s a decade-long anchor on their ability to save, invest, and take risks.

- The Strategy: Take the Free Money: The RESP is your primary tool for this goal, for one reason: the Canada Education Savings Grant (CESG). The government gives you a 20% match on your contributions (up to $500 per year). This is a guaranteed, risk-free 20% return. You will not beat this anywhere else. It is non-negotiable. It’s Not Just for University: An RESP can be used for a wide range of post-secondary education, including trade schools and colleges. This is critical. If your child chooses to become a skilled tradesperson (like an electrician or plumber), where the ROI is often extremely high, the RESP funds can still be used. You are saving for their education, not just a traditional university path.

- The Investment: With an 18-year horizon, you can be aggressive. A globally diversified, low-cost equity ETF is the right tool. As your child approaches age 14-15, you begin to de-risk the portfolio, shifting assets into bonds and GICs to preserve the capital for when it’s needed.

4. Your Own Retirement (Horizon: 20-40+ years)

- The Plan: Retirement is the ultimate long game. The key is simple: save consistently over decades while minimizing fees and taxes. Compounding is your greatest ally—but it only works if you start early and stay disciplined. Even modest monthly contributions can snowball into life-changing wealth over 30–40 years.

- The Tools: Your TFSA and RRSP.

- The Investment: For most beginners, the smartest move is to keep it simple: A single, globally diversified, low-cost all-in-one ETF (e.g., VEQT or XEQT). These funds automatically spread your money across thousands of companies worldwide and rebalance for you. If you want more control, you can build a mix of ETFs yourself, but don’t let complexity delay your start. A great resource is the Canadian Couch Potato https://canadiancouchpotato.com

- Example: If you invest $500/month starting at age 25 and earn an average 7% annual return, by age 65 you’ll have ~$1.2 million. Wait just 10 years (start at 35), and you’ll end up with only ~$570,000. Time is everything—your future wealth is built on today’s discipline. If you feel like you are too young to worry about retirement yet, then remember, you can use this money for your first home purchase too!

- The Discipline: Automate contributions so investing happens without you thinking about it. Ignore the noise during market crashes. Every downturn in history has eventually been followed by recovery and growth. The wealthy are not those who time the market, but those who stay in it.

Part 6: Your Action Plan (Build Your Plan, Question Their Products)

- Get Your Data: Use a financial aggregator like Wealthica or Monarch Money to see your true financial picture.

- Model Scenarios: Use a tool like ProjectionLab to ask “what if?” This is what real financial planning looks like.

- Automate Your Plan: Set up automatic transfers. Make your plan the default.

- Arm Yourself for a Banker Meeting: Force them to talk about your plan, not their product.

- “Before we talk about any products, can you show me a financial plan that models my goals?”

- “This product you’re showing me—what are the total fees in dollars, and how will that fee impact my plan’s outcome over 20 years?”

- “How has this fund performed against its benchmark index, after fees, over the last 10 years?”

- “Are you legally acting as a fiduciary in my best interest, or are you a salesperson?”

Your financial future will be determined by the quality of your plan and your discipline in executing it. Stop buying products. Here’s how to start now:

Year One Financial Action Plan

Think of Year One as laying the foundation. You don’t need to master everything at once. Your goal is to set up systems so good habits run automatically.

Months 1–2: Get Organized

- List your numbers: • Net income (after tax, monthly) • Debts (student loans, credit cards, car loans) • Assets (cash, savings, investments)

- Download a financial aggregator app (Wealthica, Monarch Money, Mint + Projection Lab).

- Create a simple monthly budget (50% needs, 30% wants, 20% savings/debt repayment).

Months 3–4: Build Your Safety Net

- Open a high-interest savings account for your emergency fund.

- Set up an automatic transfer ($100 - $250/month or what you can afford).

- Aim for $1,000–$2,000 by year’s end as your starter emergency fund.

Months 5–6: Tackle Debt

- Make a debt inventory: list balances, interest rates, and minimum payments.

- Choose a repayment method: Avalanche (highest interest rate first) or Snowball (smallest balance first)

- Automate extra payments toward your chosen priority debt.

Months 7–8: Start Investing (Defense Mode)

- Open a TFSA (priority) or RRSP if you’re in a higher tax bracket.

- Set an automatic transfer (even $50–$100/month to start).

- Choose a low-cost all-in-one ETF or robo-advisor for simplicity.

Months 9–10: Plan for Big Goals

- If buying a home in the next 5–10 years, open an FHSA (First Home Savings Account).

- Compare mortgage rates from 3 lenders.

- If you have children, open an RESP and set automatic contributions ($50–$100/month) to capture the 20% government match.

Months 11–12: Strengthen and Automate

- Increase automatic contributions by a small amount if your budget allows.

- Review your insurance (health, disability, tenant/home).

- Schedule a year-end money review: Did you hit your savings goals? Is your emergency fund growing? Is debt reduction on track? Do you need to adjust your budget?

Year One Goals Recap

By the end of the first 12 months, you should have:

- A working budget and financial dashboard

- A starter emergency fund ($1,000–$2,000)

- An automated savings and investing system (TFSA/RRSP)

- A debt repayment plan in motion

- Accounts opened for bigger goals (FHSA, RESP if applicable)

None of this is easy or fun. If you can get someone to help you, great! If you can't afford help or find anyone willing, then its up to you. That's what adulting is all about - realizing that the safety net is gone and that those 'adults' you were looking up to... they were just doing their best too.

I hope this is helpful. As I noted at the beginning, I'm no financial Guru, but I wish someone had told me these things in my 20's!

Intermediate Financial Adulting 201:

Your 30s & 40s

Let's be clear: the financial advice that got you here won't get you there. The basics—a TFSA, some automated savings, maybe a starter ETF—are just that: basic. They are the financial equivalent of showing up to the gym. The real work, the part that builds meaningful wealth, starts now.

This is not a guide for beginners. This is for people in their mid 30s and 40s who are moving from a mindset of saving to a mindset of wealth creation. We're going to cut through the noise and focus on the handful of things that actually move the needle. This isn't about stock tips or chasing the next hot trend. It's about understanding the machine—inflation, taxes, market cycles—and making it work for you, not against you.

Forget generic advice. It's time to get specific, strategic, and serious

Stop Flying Solo, Build Your Team

In your 20s, you could get away with a DIY approach to finance. In your 30s and 40s, that's malpractice. Your financial life now has too many moving parts—taxes, estate planning, insurance, investments—to navigate alone. It's time to build a team. Think of it as your personal board of directors:

- The Tax Strategist (Accountant): This is not the person who just files your taxes. This is the person who tells you how to structure your income and investments to minimize your tax bill. They are your partner in a game where the government is trying to take as much as it can. Don't play it alone.

- The Legal Shield (Lawyer): A will and powers of attorney are non-negotiable. They are the legal armor that protects your family from chaos if something happens to you. Not having them is selfish.

- The Risk Manager (Insurance Advisor): Your ability to earn an income is your single greatest asset. Disability and critical illness insurance are not optional; they are the airbags for your financial life. Term life insurance is for your dependents. Don't confuse insurance with investment.

- The Capital Allocator (Wealth Advisor): This is the most controversial member of the team. If you have the discipline and interest to manage your own portfolio, you may not need one. But if you don't, a fee-based advisor who acts as a fiduciary is your best bet. Their job is to be the unemotional, rational force in your investment decisions.

The Three Truths That Matter Most + One More

1. Inflation is a Tax on the Uninvested

Cash is not safe. It is a guaranteed loser. At 3% inflation, every $100,000 you have in a savings account is losing $3,000 in purchasing power every year. The only way to win is to own assets that outrun inflation. That means equities and real estate. GICs are for your emergency fund, not your wealth-building engine.

2. The Price You Pay Determines Your Return

This is the single most important concept in investing. J.P. Morgan's data is brutally clear: the higher the price you pay for an asset, the lower your future return.

The S&P 500 is trading at ~23x forward earnings. The data says you should expect mediocre returns from here. This isn't a prediction; it's a probabilistic statement. Don't be surprised when the party ends.

3. Your Canadian Passport is Not an Investment Strategy

Canada is 3% of the global stock market. If your portfolio is more than 20% Canadian stocks, you are not diversified; you are making a concentrated bet on a small, commodity-driven economy. Own the world. Use low-cost ETFs like XAW or VEQT to do it.

4. Cash is Not Trash—It's Optionality (Not Everyone Agrees Here!)

The investment world will tell you that "cash is trash" and you should be "fully invested at all times." This is amateur thinking.

Cash—when held strategically—is not dead money. It's a call option on opportunity. Private equity firms don't keep billions in "dry powder" because they're stupid. They keep it because they understand that the best investments come when others are forced to sell.

Your dry powder serves the same purpose. It's not about timing the market perfectly. It's about being ready when the market hands you a gift—and it always does, eventually.

The question isn't whether the next crisis will come. The question is whether you'll have the ammunition to take advantage of it when it does.

The BIG caveat here, is that this is NOT accepted as gospel, in-fact data supports that you shouldn't bother worrying about this (see below), and that you should just keep investing regardless (see below). However, I'm not afraid to tell you what I do even though its contrarian - because no one has really figured out the bullet proof approach anyways!

What to Do With This Information

Knowing that markets are expensive is academic unless you act on it. Here's how:

When Forward P/E > 22× (like today at ~23.6×):

- Slow your equity purchases. Don't stop, but be selective.

- Build cash reserves. This isn't "timing the market"—it's preparing for opportunity.

- Focus new money on international markets or value sectors that haven't participated in the party.

- Accept that your returns will likely be mediocre for the next decade. Plan accordingly.

When Forward P/E < 18× (rare, but it happens):

- Accelerate your equity purchases. This is when you get aggressive.

- Deploy every dollar of dry powder you've been accumulating.

- These moments don't last.

- This is when generational wealth is built. Don't be on the sidelines.

The math is simple: buy more when things are cheap, buy less when they're expensive. The execution is hard because it requires discipline when everyone else is doing the opposite.

The 90/10 Barbell Strategy + Dry Powder for a Chaotic World

Your investment strategy needs to be simple, robust, and antifragile. The 90/10 "barbell" is the foundation, but we're adding a tactical layer that separates amateurs from professionals.

- 90% Core - The Fortress: This is your globally diversified, low-cost ETF portfolio. It is the bedrock of your wealth. You don't trade it. You don't time it. You just keep adding to it, relentlessly, every single month. This is your defense.

- 10% Explore - The Asymmetric Bets: This is your offense. This is where you speculate on the things that could have a 10x return, but could also go to zero. A single stock, a crypto asset, a pre-seed startup. If it goes to zero, you're fine. If it hits, it moves the needle.

The Dry Powder Advantage: Think Like Private Equity

Here's where it gets sophisticated. Within your 90% fortress, maintain 15-25% in "dry powder"—cash equivalents ready to deploy when markets hand you obvious opportunities.

The Traffic Light System:

Red (Defensive): Forward P/E > 22× and VIX < 15 (expensive + complacent)

- Keep 25-35% of your fortress in dry powder

- Markets are rich and everyone is comfortable. Danger.

Yellow (Balanced): Forward P/E 18-22× or VIX 15-20 (mixed signals)

- Keep 15-25% in dry powder

- Normal market conditions. Stay disciplined.

Green (Deploy): Forward P/E < 18× and VIX > 25 (cheap + fearful)

- Deploy down to 5-10% dry powder

- Fear is in the air. This is when you get greedy.

Execution Rules:

- Check monthly, act quarterly. No day-trading.

- When Green triggers, deploy in thirds: immediately, after a 5% additional dip, then weekly until conditions change.

- Park dry powder in GICs/T-Bills or high-interest savings. Earn yield while you wait.

- This operates within your 90% core allocation, not separate from it.

Why This Works: You're not trying to time the market perfectly. You're positioning yourself to take advantage when the market serves up obvious opportunities—like March 2020, October 2008, or the next crisis that's always coming.

The amateurs are either all-in (FOMO) or all-out (panic). The professionals keep powder dry and deploy it when others can't.

Notes:

- Don't forget time horizons and consider changing your allocations depending on that factor.

- Primary residence % naturally declines as net worth grows, even if your home is expensive — because your portfolio and other assets expand faster.

- Cash reserves stay relatively steady as a % of net worth, but in absolute terms they scale up (HNWI often keep $500k+ liquid).

- Alternatives (private equity, business ownership, real estate beyond the home, collectibles, etc.) become a bigger slice at higher wealth levels.

- Equities vs. Fixed Income follow the classic logic you already outlined: younger/early-stage = equities heavy; wealthier = more balanced with bonds.

Tax is a Drag on Your Returns. Minimize It.

- Asset Location is Key: Don't just think about what you own, but where you own it. Interest-bearing assets (bonds, GICs) go in your tax-sheltered accounts (RRSP/TFSA). Equities, with their more favorable tax treatment, can live in your taxable account.

- The TFSA vs. RRSP Decision: It's simple. If you think you'll be in a higher tax bracket in retirement, use your TFSA. If you think you'll be in a lower tax bracket, use your RRSP. For most people in their 30s, the TFSA is the right answer.

Major Milestones: Don't Be a Tourist

- Mortgages: Your mortgage is a commodity. Treat it like one. At renewal, make the banks compete for your business. A 0.25% difference in your rate is thousands of dollars over the life of the loan. Don't be lazy.

- Home Buying: The FHSA is a gift from the government. Use it. It is the single best home savings tool ever created in Canada. Max it out before you even think about the HBP.

- CPP: The government is betting you'll take your CPP early. That's a bad bet for you. Unless you have a compelling reason not to, delaying your CPP to 70 is one of the best-returning, lowest-risk investments you can make.

The Unsexy but Crucial Stuff: Risk Management

- Insurance: You are not a unique snowflake. You are a statistic. And statistically, you are more likely to be disabled than to die in your peak earning years. Buy disability insurance. If people depend on your income, buy term life insurance. It's that simple.

- Estate Planning: A will is not about you. It's about making a terrible time in your family's life a little less terrible. Get a will. Get powers of attorney. It's the most adult thing you can do.

Action Plan

Monthly (New Addition):

- Check Your Traffic Light: Review Forward P/E and VIX. Are you in Red, Yellow, or Green territory?

- Adjust Dry Powder Accordingly: Don't overthink it. Follow the system.

This Quarter:

- Know Your Number: Calculate your net worth. What you measure, you manage.

- Audit Your Portfolio: Are you globally diversified? Or are you a Canadian home-bias tourist?

- Get Your Legal House in Order: Will and powers of attorney. No excuses.

Annually:

- Rebalance Your Fortress: The market will try to throw your 90% core allocation out of whack. Rebalance it back to target.

- Deploy or Accumulate: If you're in Green territory, deploy dry powder. If you're in Red, build it up.

- Max Your Accounts: TFSA, RRSP, FHSA. These are your tax-free zones. Use them.

Disclaimer: This is not financial advice. Your financial decisions are your own. Consult a professional.

What Has Been Driving The Market?

Four AI stocks are the entire market rally. Here’s what that means for your portfolio.

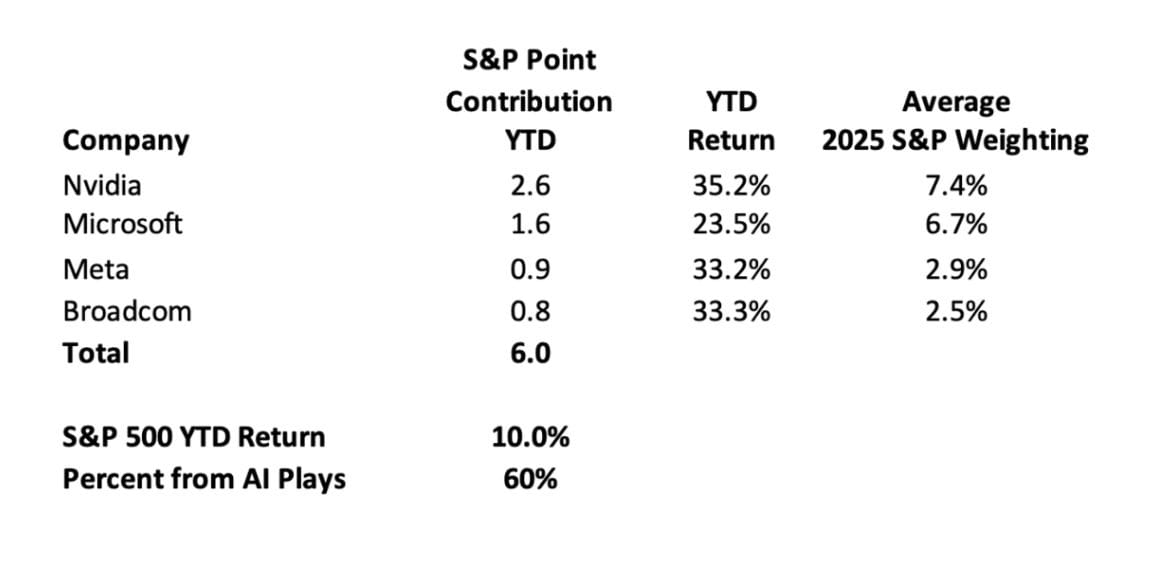

RBC just dropped the numbers that should terrify every “diversified” investor: NVIDIA, Microsoft, Meta, and Broadcom have contributed 6.0 points to the S&P 500’s 10% YTD return. That’s 60% of the entire market’s gains from just four companies.

NVIDIA alone accounts for 2.6 points - 26% of the index’s performance despite being 7.4% of its weight. Without these AI plays, the S&P would be up 4% instead of 10%.

This isn’t diversification. It’s concentration risk masquerading as market performance.

The Efficient Market Hypothesis says this shouldn’t happen. But here we are.

Three scenarios ahead:

- Bubble: We’re pricing superintelligence decades away while 50% of VC funding chases AI dreams. LLM limitations suggest reality check coming.

- Revolution: McKinsey estimates $2.6-4.4 trillion annual value from generative AI. We’re underpricing the productivity transformation.

- Efficient: Markets already reflect probability-weighted outcomes. Current prices are fair.

For my AI portfolio, I thought “full stack.” Below are examples (I don’t want to make specific recos or share my exact portfolio allocations):

- Core (65-70%): Proven leaders like NVIDIA, Microsoft, Meta, Broadcom, Alphabet, Oracle, plus diversified AI ETFs (AIQ, ARKQ) and semiconductor plays (TSM, ASML).

- Growth (20-25%): High-conviction bets like Tesla (autonomous/robotics), Palantir, and robotics ETFs (BOTZ).

- Speculative (5-10%): Moonshot positions in AI startups and niche plays.

Core gives stability, Growth captures trends, Speculative adds optionality without risking everything.

The Efficient Market Hypothesis says you can’t beat the market consistently. But it acknowledges exceptions during paradigm shifts. We’re living through one.

The question isn’t whether AI inefficiencies exist - the 60% concentration proves they do. The question is how long they persist and which scenario we’re pricing.

RBC estimates 6-14% downside if AI hits a pothole. Position accordingly, but remember: when the market depends on four stocks, diversification isn’t what you think it is.

Member discussion: